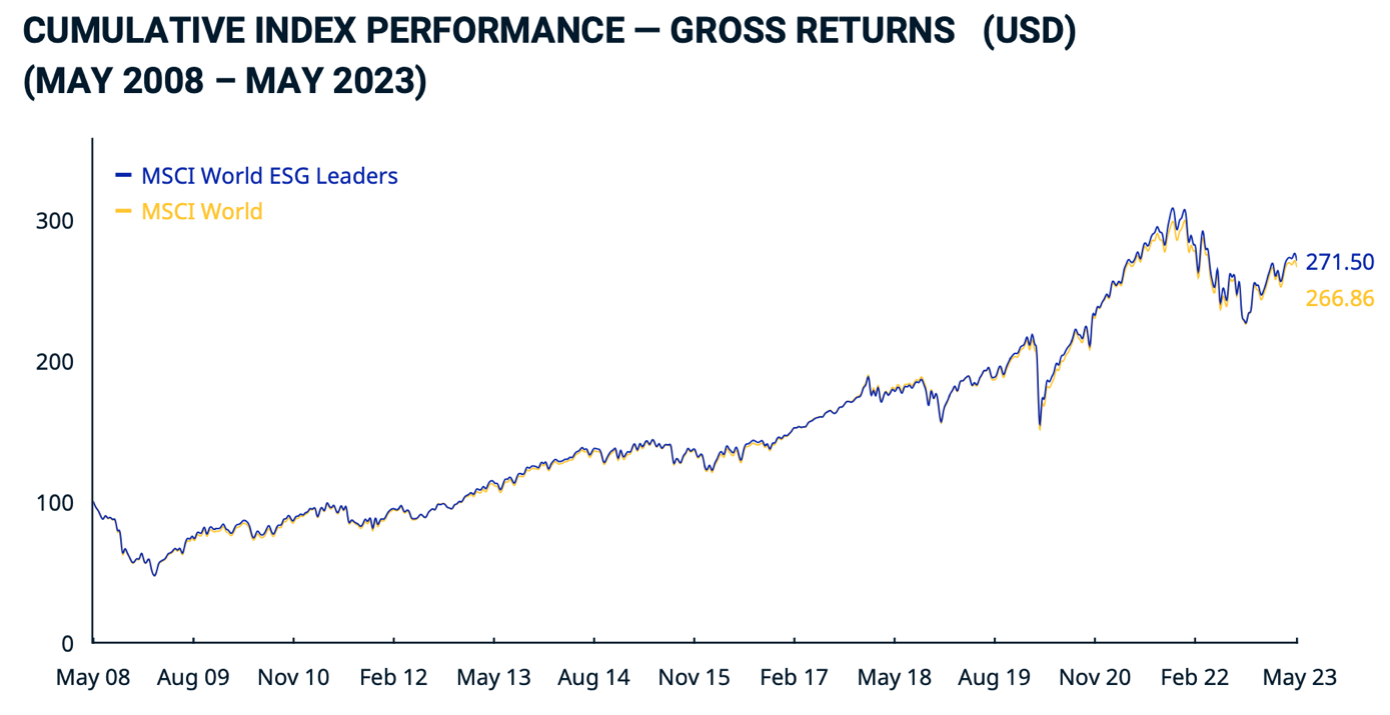

Zdi se, da so vpliv sankcij proti Rusiji, neravnovesje med ponudbo in povpraševanjem, negotovost ponudbe v kombinaciji z naraščajočo inflacijo in visokimi cenami energije, ki povzročajo korenit premislek ne le o energetski politiki, temveč tudi o varnostnih vprašanjih in naložbenih metodah po svetu, le začasno vplivali na donose naložb ESG v letu 2022. V zadnjem letu je indeks MSCI World ESG Leaders, ki ga sestavljajo podjetja z veliko in srednjo tržno kapitalizacijo v 23 razvitih tržnih državah, dosegel 2,95-odstotni bruto donos, medtem ko je tradicionalni indeks MSCI World dosegel 2,61-odstotni donos, kažejo podatki s spletne strani msci.com (podatki so posodobljeni na dan 31. maja 2023). Tudi če pogledamo petletno primerjavo, lahko vidimo, da ima različica indeksa ESG, ki je zasnovana tako, da predstavlja uspešnost podjetij, izbranih iz matičnega indeksa MSCI World na podlagi okoljskih, družbenih in upravljavskih (ESG) meril, rahlo prednost. Dosegla je 8,93-odstotno uspešnost, medtem ko je tradicionalni indeks MSCI World dosegel nekoliko nižjo uspešnost, in sicer 8,34-odstotno. * Ti podatki so nedvomno ključni pri odločanju o prihodnji sestavi portfelja vsakega vlagatelja.

Razvoj vrednosti indeksa MSCI World ESG Leaders v primerjavi s tradicionalnim MSCI World od maja 2008 do maja 2023 (Vir: msci.com)*

ESG kot naložba v prihodnosti

Asi 60 odstotkov vlagateljev poroča, da je ESG v primerjavi z enakovrednimi naložbami brez ESG že prinesel višje donose, kar lahko v prihodnjih letih še poveča zanimanje za to vrsto naložb. * Poročilo PwC Asset and Wealth Management Revolution 2022 ocenjuje, da bodo institucionalne naložbe, usmerjene v ESG, do leta 2026 zabeležile 84-odstotni porast na 33,9 bilijona dolarjev, kar predstavlja 21,5 odstotka sredstev v upravljanju. Še en dejavnik, ki govori v prid širjenju naložb ESG, je, da po navedenem poročilu kar osem od desetih ameriških vlagateljev v naslednjih dveh letih načrtuje povečanje deležev v produktih ESG [1].

Širitev ponudbe

Vendar ob upoštevanju teh ocen se pričakuje, da bi se lahko trg v prihodnjih letih bistveno odprl, razširil ponudbo produktov ESG in da bodo upravljavci premoženja po vsem svetu do leta 2026 s prvotnih 18,4 bilijona dolarjev leta 2021 povečali svoja sredstva v upravljanju (AUM), povezana z ESG, na 33,9 bilijona USD. S predvideno 12,9-odstotno sestavljeno letno stopnjo rasti so sredstva ESG na dobri poti, da v manj kot petih letih predstavljajo 21,5 odstotka vseh globalnih AUM. [2]

Evropa v primerjavi s svetom

Z vidika odstotnega deleža v Evropi je bilo ob koncu leta 2021 27 odstotkov skladov pretvorjenih v integrirane dejavnike ESG. V ZDA je AUM, usmerjen v ESG, leta 2021 znašal 4,5 bilijona dolarjev, do leta 2026 pa naj bi se povečal na 10,5 bilijona dolarjev. V Evropi bi lahko v istem obdobju dosegla celo 19,6 bilijona ameriških dolarjev. [3] Seveda se porast zanimanja pojavlja tudi zunaj EU in ZDA, čeprav druge regije precej zaostajajo za tema dvema. Vendar pa vlagatelji povečujejo svoje dodelitve naložbam ESG tudi v Aziji, na Bližnjem vzhodu, Pacifiku, v Afriki in Latinski Ameriki, kjer za primerjavo naložbe ESG v AUM trenutno znašajo približno 25 milijard USD.

Letvica pričakovanj se še naprej dviguje

Na trgu je še vedno zmeda glede tega, kaj vlagatelji in zakonodajalci štejejo za zeleno in družbeno vključujoče. Po drugi strani pa se obe zainteresirani strani vse bolj osredotočata na podporo podjetjem, ki se preobražajo v zelena podjetja. Finančne institucije z močno ponudbo ESG vse bolj veljajo za konkurenčno prednost pred tistimi, katerih ponudba na tem področju zaostaja, in imajo nalogo razvijati portfelje, ki lahko vzdržijo nestanovitnost trga, se odzovejo na vse večji nabor regulativnih zahtev in prepoznajo priložnosti za trajnostno rast, ki bo prinesla dolgoročne rezultate.

Obenem se pričakovanja povečujejo, saj se ta segment premika naprej in izboljšuje. V EU, na primer, za izpolnjevanje predpisov ni več dovolj razkriti in pojasniti večjih negativnih vplivov, povezanih z dejavniki ESG, kot so emisije toplogrednih plinov, ogljični odtis, protikorupcijski ukrepi ali sodobno suženjstvo. V zadnjem času se od podjetij pričakuje, da te vplive ublažijo in odpravijo temeljne vzroke teh težav.

Olivia Lacenova, glavna analitičarka v podjetju Wonderinterest Trading Ltd.

* Pretekli rezultati niso zagotovilo za prihodnje rezultate

[1, 2, 3] V prihodnost usmerjene izjave temeljijo na predpostavkah in trenutnih pričakovanjih, ki so lahko netočna, ali na trenutnem gospodarskem okolju, ki se lahko spremeni. Takšne izjave niso jamstvo za prihodnjo uspešnost. Vključujejo tveganja in druge negotovosti, ki jih je težko predvideti. Rezultati se lahko bistveno razlikujejo od tistih, ki so izraženi ali nakazani v izjavah o prihodnosti.