Retreat from the highs

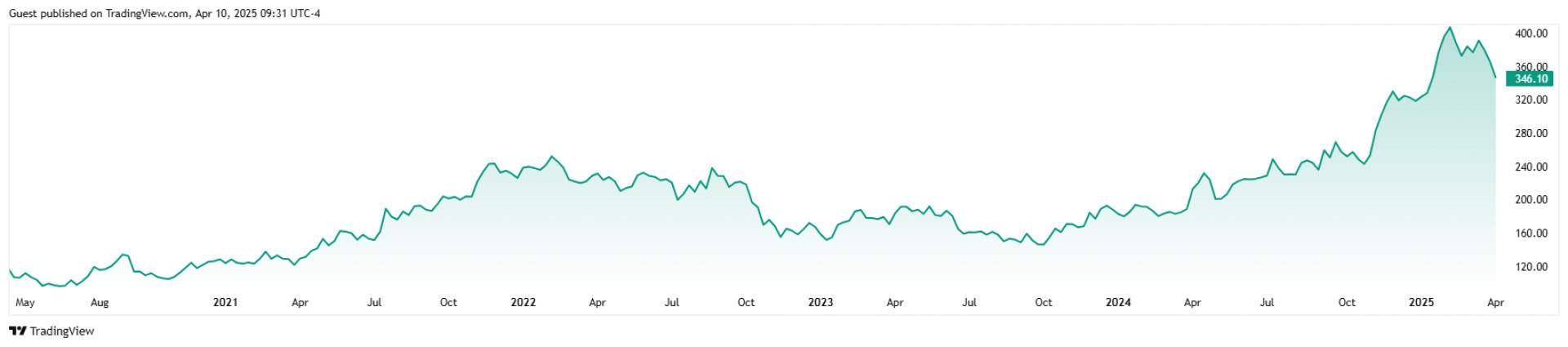

The price of Arabica coffee futures contracts sharply dropped since the beginning of April, reaching the lowest levels since the end of January this year, when, by April 10, 2025, it stood at $346 per pound (0.45 kg). This followed a rise to the historically highest level of $425 in mid-February. Despite the decline, the contracts remained in the green. For comparison, their price has increased by 63 percent over the past year, and by 186 percent from a 5-year perspective.*

The price development of Arabica coffee futures contracts over the past 5 years. (Source: Trading View)*

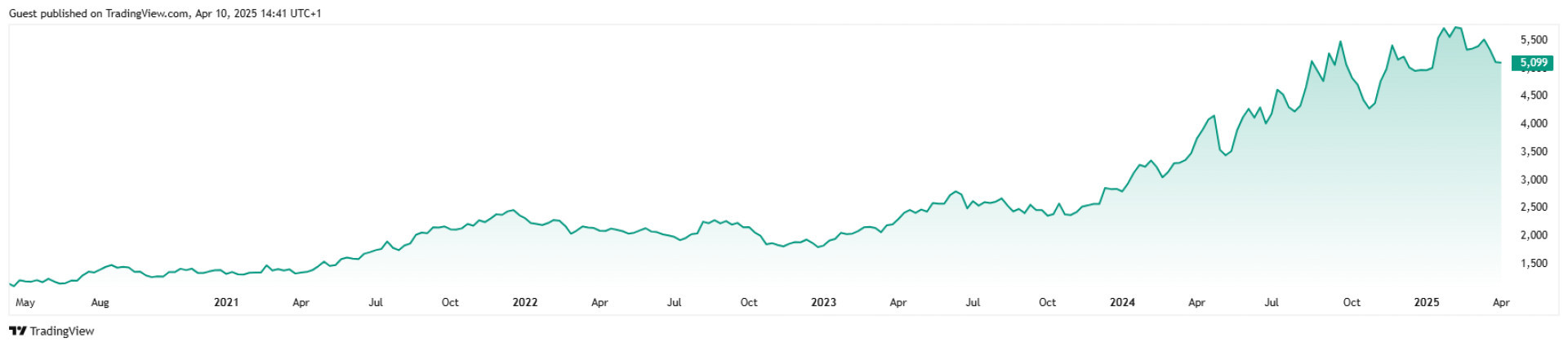

A similar trend occurred with Robusta coffee contracts, which fell from their peak of $5,817 in January to below $5,000 by April. However, by April 10, 2025, they partially reduced their losses, rising to $5,099. From a one-year perspective, their performance was slightly lower than Arabica's, at just under 37 percent, but over the past 5 years, their value increased by as much as 324 percent.*

The price development of Robusta coffee futures contracts over the past 5 years. (Source: Trading View)*

Escalating Tensions

The sell-offs, like those in the rest of the market, were caused by the announcement of Trump’s tariffs, which affected a broader list of countries. These ranged from 10 percent basic tariffs on all imports to the States to increased tariffs on certain economic entities, including 20 percent on the European Union (EU). The changes took effect on April 9, 2025, but just a few hours later, the U.S. president declared a 90-day delay. This did not apply to China, where tariffs were raised to 125 percent. The tension escalated with reciprocal 84-percent tariffs from Beijing on American goods entering the country. It is likely that China will not be the only one to take such a step.

Advantage for Brazil?

Regarding countries like Vietnam and Indonesia, which are among the largest producers of Robusta, tariffs of 46 and 32 percent have been imposed on them. This could benefit the leader in Arabica coffee production, Brazil, as it would only face a 10 percent tariff increase, given the potential rise in demand for the "cheaper" variant from the U.S. coffee market. If this happens, Brazil would increase its coffee exports to the United States, which was the largest importer last year. Overall, the U.S. bought 8.1 million 60-kilogram bags, accounting for 16 percent of Brazil’s total coffee exports, while Vietnam and Indonesia together exported only 2 million bags. According to Reuters, the Brazilian Coffee Exporters Council (Cecafé) notes that problems could arise if exemptions are granted—if Brazilian beans are excluded while Vietnamese beans are included.

Weather Continues to Apply Pressure

According to Cecafé, Brazil can maintain its share of the U.S. market, but the challenge remains the declining production caused by bad weather conditions. The Brazilian National Supply Agency (Conab) expects a year-on-year drop of 4.4 percent for the 2025/2026 season, with total production forecast at nearly 52 million bags (60 kg). Of this, Arabica is expected to account for 34.7 million bags, a 12 percent decrease. The remainder will be Brazilian Robusta, with production projected to increase by 17 percent. Forecasts from one of Brazil’s largest exporters, Comexim, are also not positive, as they expect a 1.8 percent decrease in total coffee bags. For Arabica, the expected decline is the same 12 percent. According to the U.S. Department of Agriculture, global coffee production for the 2024/2025 season is expected to decrease compared to the previous year but will rise compared to the 2023/2024 season. According to Food Business News, the increase is mainly due to higher production in the aforementioned Asian countries.

More Expensive Chocolate in the U.S.

Similar to coffee, another agricultural commodity, cocoa, has been affected. Americans will have to pay more for chocolate since a 21 percent tariff has been imposed on cocoa imports from the Ivory Coast, the world’s largest producer. They will also pay more for cocoa butter and other products from the EU, Indonesia, and Malaysia (24 percent). The demand for cocoa products could also be influenced by weaker production.

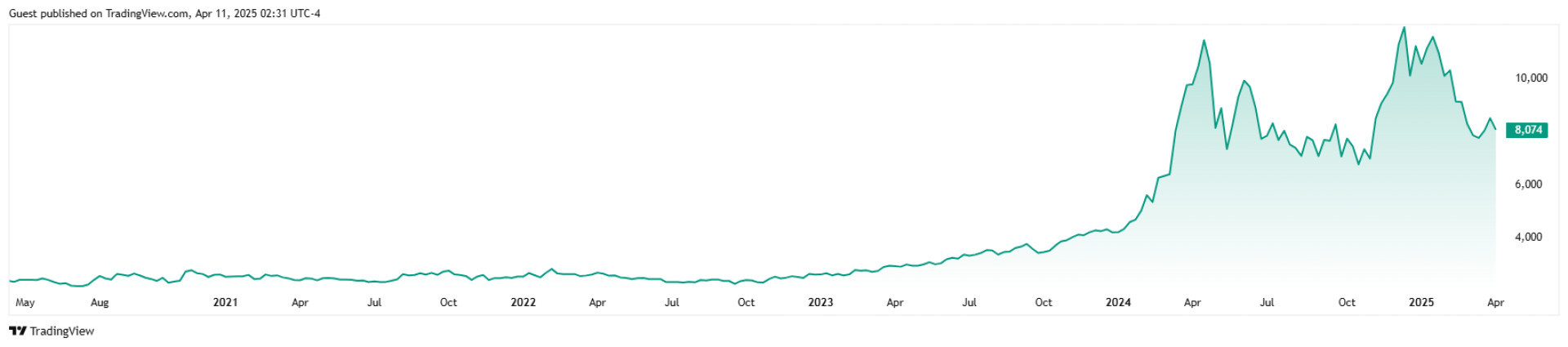

On the Exchange, Losses Extend

Cocoa futures on the International Exchange in New York fell to $8,133 per ton by April 10, 2025. In early April, they briefly rose, but since the beginning of the year, they have already lost more than 30 percent. Compared to last year, their price has dropped by 16 percent, but over the last 5 years, the price has increased by 249 percent.*

Development of Cocoa Futures Prices Over the Last 5 Years. (Source: Trading View)*

*Past performance is not a guarantee of future results.