According to CNBC, the most significant news from Xpeng is the plan to launch test drives of a robotaxi fleet already in 2026, specifically in its home city of Guangzhou and other key Chinese cities. A total of three models were introduced, each equipped with up to four specific Turing AI chips with a performance of 3,000 TOPS. According to the company’s leadership, this should be the highest performance in the broader automotive sector by a clear margin. On the other hand, the vehicle software will be powered by the second-generation Vision-Language-Action (VLA) model, capable of effectively processing both visual and linguistic stimuli and making autonomous decisions in real time. On a technological level, this represents a major shift that allows Xpeng to free itself from reliance on external American graphics chips.

Cooperation with Alibaba’s Division

In addition, the manufacturer has entered into a partnership with the AutoNavi division of Alibaba, which will make it possible to integrate navigation and the driving portal directly into the robotaxi service. Brian GU, the company’s co-president, was still somewhat skeptical about this project a year ago, but according to his latest statements, computing performance is increasing faster than originally expected, making it possible for robotaxi to become a common part of Chinese city streets very soon.

Plan to Launch Mass Production of Robots

Alongside autonomous vehicles, Xpeng also surprised with the second generation of its humanoid robot named Iron, whose mass production is planned for next year. However, it is important to add that in the initial phases, the robot is expected to be used more as a guide in showrooms, retail stores, or reception areas rather than as a full-fledged worker in factories – mainly due to high costs compared to the price of human labor in China. However, CEO He Xiaopeng indicated that within ten years, the number of humanoid robots could eventually exceed the number of cars sold.

Stock Value Rises Sharply

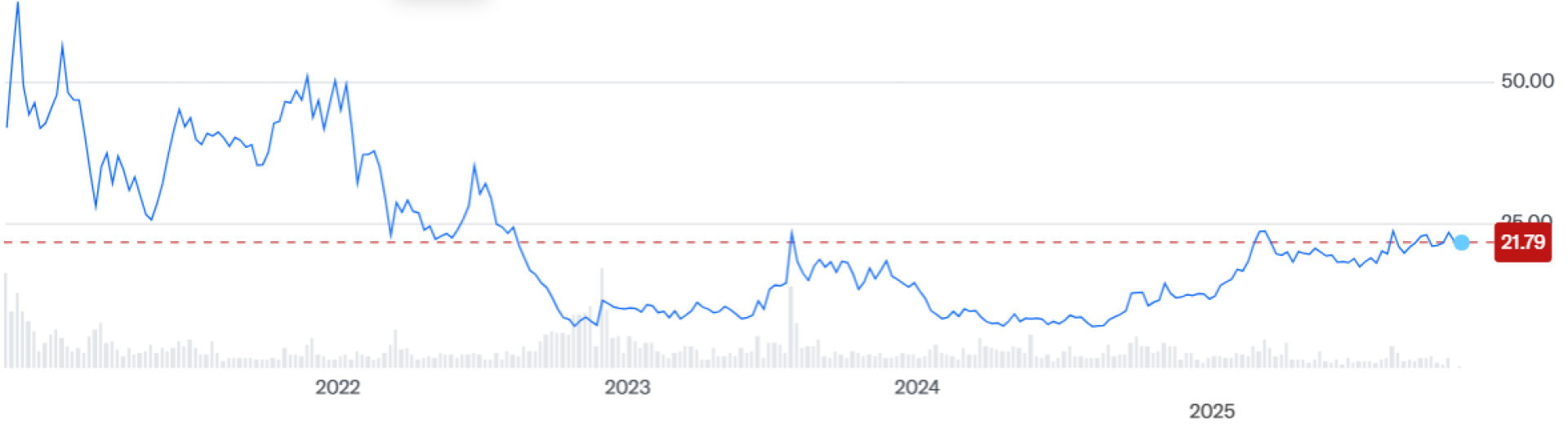

Unlike Tesla, which tests its robotaxi in Texas, Xpeng focuses primarily on the complexity of its autonomous solutions, while placing significantly less emphasis on marketing compared to the competition. Xiaopeng himself noted: “In many areas, such as humanoid robots or flying vehicles, we started earlier than Tesla – we just talked about it less.” The value of Xpeng shares has risen by almost 100 percent since the beginning of the year. For comparison, Tesla’s performance for the same period reaches approximately 20 percent. From a longer-term perspective, the situation is somewhat different. Xpeng trades about 50 percent below its absolute peak, while Tesla has delivered more than 140 percent to investors over the same period. On the other hand, for Xpeng this represents a potential increase in value of 270 percent in the future, but only in the case of a return to its mentioned absolute maximum.* [1]

Performance of Xpeng’s stock price over the past five years*

Performance of Tesla’s stock price over the past five years*

*Past performance is not a guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations that may be inaccurate or may rely on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ significantly from the results expressed or implied in any forward-looking statements.