Opinions Differ

The World Gold Council (WGC) remains positive but notes in its December report that growth will be more moderate this year compared to 2024.[1] Bank of America (BoA) and Citi remain confident in the resilience of the precious metal, with forecasts reaching $3,000 per troy ounce.[2] According to Reuters and Benzinga, Citi and BoA expect gold to reach this level in the first half of 2025.[3] Goldman Sachs estimates a slightly lower forecast of $2,900 at the start of the year, with the price expected to rise to nearly $3,000 later.[4] Analysts from JPMorgan also lean towards this scenario.[5] A more conservative view comes from Commerzbank and ANZ, expecting $2,600 by mid-year with growth towards $2,900.[6] While most predictions are on a positive trend, banks like Barclays and Macquarie, according to the Financial Times, anticipate a decline to around $2,500 in 2025. As the saying goes, exceptions should only confirm the rule.[7]

Current Movements

Positive forecasts from most strong financial houses follow a strong 2024 when gold rose by over 27%, marking the largest increase in 14 years.* In October 2024, gold reached a historic high of $2,800 for futures contracts with February 2025 delivery, with the highest spot price being $2,786.* As of January 13, 2025, gold was near its peak. Futures contracts for February 2025 delivery were trading at around $2,680, while the spot price was over $2,660 per ounce.*

The price developments of gold futures for delivery in February 2025 over the last 5 years. (Source: Investing.com)*

Price development of spot gold over the last 5 years. (Source: Investing.com)*

Trump's Decisions Will Play a Crucial Role

The political and economic situation in the United States will continue to significantly influence gold's movements. The economic plans of the incoming President Donald Trump, including tariffs and mass deportations aimed at increasing domestic production, are expected to support the growth of this precious metal. However, many believe this could bring numerous negatives, from deepening trade wars to overall deterioration of the country's economic health. Similar to 1930, when Herbert Hoover raised tariffs by up to 60%, worsening the Great Depression. On one hand, gold could benefit from the uncertain situation as a safe haven, while on the other hand, increased debt and inflation due to Trump's policies could affect the Fed's plans to cut rates. During the December meeting, Chairman Jerome Powell expressed concerns about the upcoming Trump administration, leading to a decision to slow the pace of rate cuts from the original four to just two reductions, totaling 50 basis points. Despite this decision, the situation remains favorable for gold, as lower rates make it more attractive to investors.

Growth with Different Causes

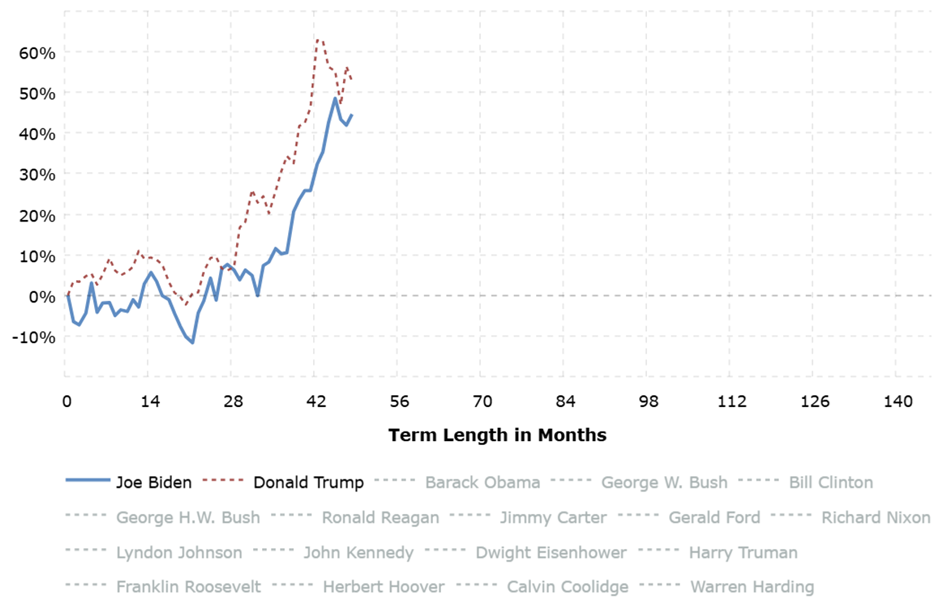

Comparing gold's performance during Biden's and Trump's administrations, both periods saw significant growth but due to different factors. During Trump's administration from 2017 to 2021, gold rose by a remarkable 52%.* After Biden took office, it continued to rise to current levels, but by "only" 44%.* The growth during Trump's term was influenced by factors including geopolitical tensions, trade wars, and the onset of the COVID-19 pandemic, which increased demand for gold as a safe haven. Trump's "America First" policy, including tariffs and sanctions, contributed to global uncertainty, prompting many investors to direct their finances into gold. Biden's term was characterized by persistent inflation, Federal Reserve rate adjustments, and wars. Biden's efforts to restore international alliances while overcoming tensions with China also played a role.

Gold valuation during the Trump and Biden administrations (source: Macrotrends.net)*

Bank Purchases Are Expected to Continue

Banks, along with the WGC, heavily rely on central bank purchases in their forecasts. These banks are expected to continue diversifying their reserves to reduce dependence on the US dollar. For instance, the People's Bank of China announced the resumption of gold purchases late last year. According to Mining.com, countries are expected to fill their reserves with 8 million ounces of yellow metal. This is less than last year, with the reason being the high price of gold, to which financial institutions are responding more sensitively. This is evidenced by the latest WGC data from October 2024, when the amount of gold purchased in the third quarter fell by 48% year-on-year.

Mining Will Grow More Significantly

Regarding global production, the research and advisory firm CPM Group expects it to rise by 1.5% to more than 88 million ounces. This is significantly more than last year, when only a 0.5% increase was recorded. In addition, the supply of recycled gold could reach 41 million ounces, representing a 10% increase, while newly processed gold is expected to rise by less than 4% compared to 2024, specifically to nearly 137 million ounces.

* Past performance is no guarantee of future results

[1], [2], [3], [4], [5], [6], [7] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.