Record Highs

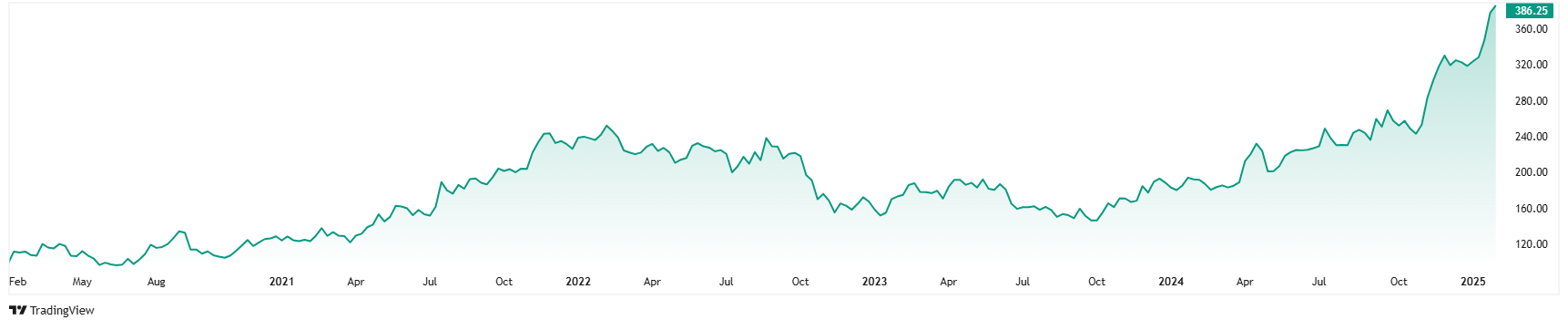

Continuous contracts for coffee Arabica (KC1!) reached a new all-time high of $3.9 per pound (approx. 0.45 kg) on February 3, 2025, on the Intercontinental Exchange (ICE).* Prices were already approaching the $4 mark in the last week of January. The contracts have been in an uptrend since fall 2023, with the most significant surge occurring at the end of last year. Compared to early February 2024, prices have soared over 98%, while from a five-year perspective, they have jumped 290%.*

Price development of continuous contracts for coffee Arabica over the last five years. (Source: TradingView)*

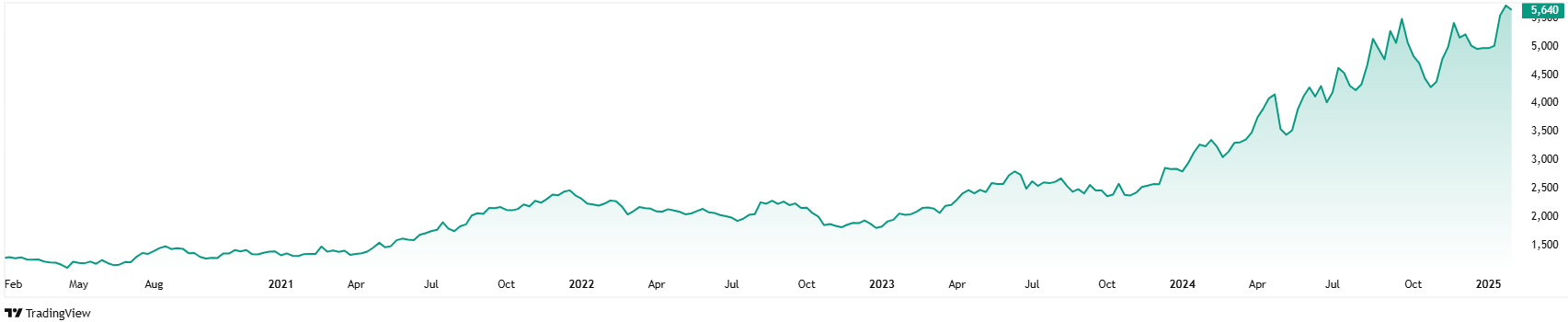

On January 30, 2025, Robusta coffee contracts also hit record levels, reaching $5.73. However, their price later declined by 0.8%, trading at $5.7 on February 3, 2025. The annual increase in Robusta contracts was 72%, while over five years, prices surged 343%.*

Price development of continuous contracts for coffee Robusta over the last five years. (Source: TradingView)*

Supplies Are Running Low

Behind the rise in prices are investor concerns about declining coffee stocks in Brazil, which globally contributes about half of Arabica coffee production. According to Reuters, the biggest producer has exhausted its stocks of the current season's crop and has only 20 to 30 percent of the crop left. In fact, stocks of certified coffee have fallen by about 100,000 bags in a matter of days. Moreover, the new crop is taking longer to become available on the market. These events are caused by bad weather conditions, where dry weather is replaced by periods of intense rainfall that damage the beans and reduce their quality. Although the weather has improved recently, concerns about below-average rainfall persist. Production forecasts for the coming season have therefore also been reduced by the Brazilian National Supply Company (CONAB). Its latest estimates, according to Comunicaffee International, call for 51.81 million bags produced, which would represent a 4.4 % year-on-year decline, according to Euronews.com. The Robusta variety, meanwhile, is facing supply problems in addition to weather issues, as Vietnamese farmers expect prices to continue to rise. New Year celebrations in Asia are also expected to contribute to the slowdown and further pressure on chains.

More Tariff Threats

The pressure on the price of coffee has also been increased by statements made by US President Donald Trump at the expense of Colombia. He published a post on his social network Truth Social on Sunday, 26 January 2025, in which he threatened to impose tariffs of 25 % on imports from Colombia, with an increase of up to 50 %. This was after the country refused to accept deported migrants as a punitive measure against US regulations on migration. For the record, the high tariffs, according to CNBC, would not only affect the price of Colombian coffee, which accounted for 20 percent of total U.S. imports in the 2023/2024 season and was just behind imports from Brazil, but also oil and cut flowers.

Consumers have already seen higher prices

Poor quality and low harvests affect everyone in the coffee 'chain', from farmers to roasters to consumers, who will feel the impact with higher prices. While some companies may increase prices or reduce packaging, consumers could see a change in preferences. In Slovakia, the price of coffee has risen every year from 2016 to 2023. Data from the Statistical Office show that in 2023 the average consumer price of roasted ground coffee was EUR 3.87 per 250 grams, an increase of almost 10 % compared to the year before. Of course, inflation and other economic indicators also played a part. Consumers also have to pay more for a good cup of coffee in cafés. This is evidenced by a survey by the European Coffee Federation (ECF), which showed price increases ranging from 5 to 15 %. According to Euronews.com, this has been happening in up to 65 % of European coffee shops since 2023. The ECF also points out that the prices of sugar, milk and consumer goods such as cups must also be taken into account in this case, which are reflected in the final price for the consumer.[1]

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.