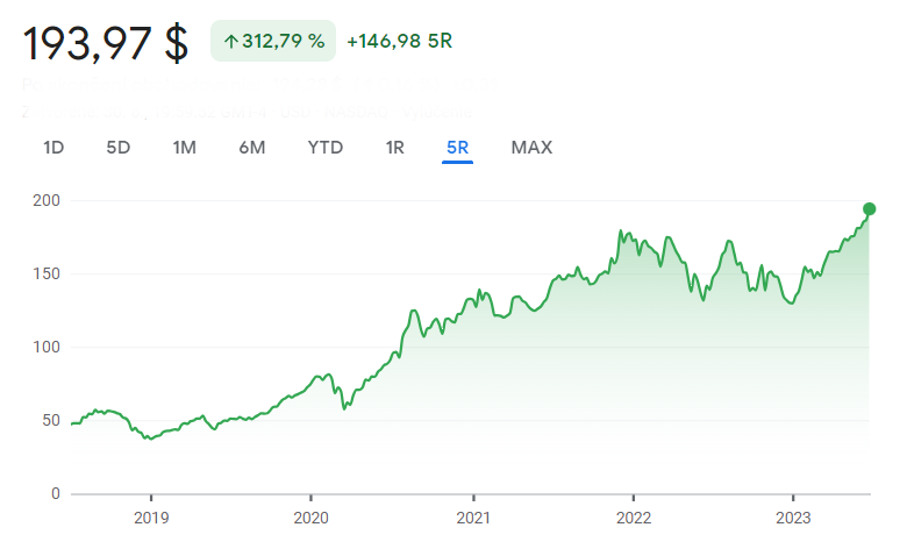

This year, Apple has increased its share value by more than 55 percent, which is great news for investors after the slight fluctuations of the previous year.* The increase in shares is mainly due to the development of artificial intelligence, new Mac models, HomePod and chip innovations. Undoubtedly the most notable product from Apple this year is a mixed reality headset called Vision Pro, which has revolutionised the sector. Shareholders are delighted with the company's success, which causesincreased positive sentiment.

Apple's stock performance over the past five years. (Source: Google) *

The end of Goldman Sachs and Apple collaboration?

On the other hand, the not-so-good news is that the world's second largest investment bank Goldman Sachs is considering discontinuing its collaboration with Apple, which began in 2019 and involved a virtual credit card. The new discussions between Goldman Sachs and American Express focus on the transfer of the credit card along with other initiatives under the aforementioned collaboration. The Apple credit card made of titanium has no visible number and provides customers with a 3 percent daily cashback reward. In addition, it allows interest-free monthly payments on Apple products. News of the termination is not yet official and the companies have declined to comment on the collaboration.

Promising collaboration between Nokia and Apple

Where something old ends, something new begins. Finnish company Nokia has entered into a long-term licensing agreement with Apple for its patents. Nokia was once a world leader in the field of handsets and so far has a broad portfolio consisting of more than 20 thousand patents, which was created after an investment of 140 billion euros (152.70 billion USD). This agreement for Nokia's intellectual property related to 5G networks and other technologies comes as the current license between the two companies expires at the end of 2023. The agreement will provide Nokia with revenue from January 2024 [1].

Olivia Lacenova, principal analyst at Wonderinterest Trading Ltd.

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.