According to Refinitiv data, U.S. companies beat quarterly estimates by 8 percent and consumer discretionary companies beat estimates by as much as 20 percent, which is surprising given the current global market situation. Despite consumer confidence dropping last month to its lowest level in nine months, data from Visa, which focuses on payment processing, shows that card payment volume for the first quarter of 2023 is up 10 percent and card balances are higher than pre-pandemic levels. This is good news for the markets. Prices have increased across the board and although sales volumes have decreased, companies are still not as badly off as expected at the beginning of the year. This is partly due to the adjustment of prices to the current situation on the markets. According to Reuters data, many global companies have increased the prices of their products by several percent, such as Nestlé by 10 percent, Coca-Cola Co. by around 11 percent or rival Pepsi by 16 percent.

Pepsi and Coca-Cola expect better forecasts for this year

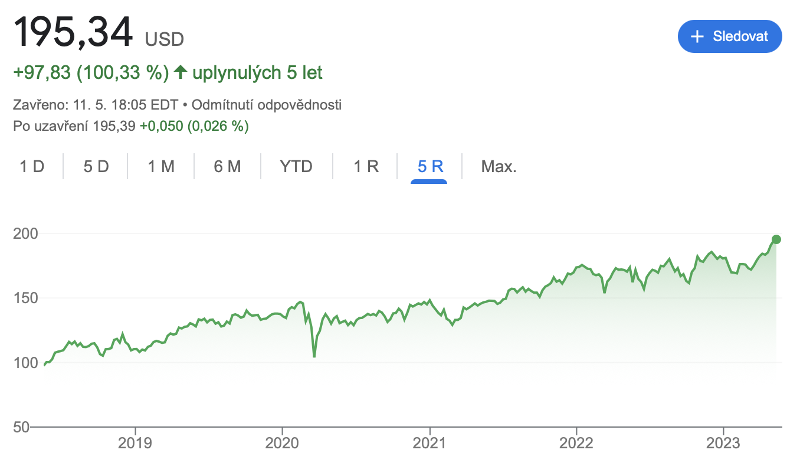

Pepsi sees the next quarter looking brighter following the release of its first quarter results this year. It has indicated that consumers are resilient to inflation and recession and, even with Nestlé, has been raising prices to combat rising costs associated with raw materials, transportation, and labour. So far, they do not expect prices to come down this year, and Pepsi is even planning to raise prices again in some regions in the North American region. Looking at the chart, the company's shares have been rising over a five-year period, and this year's expectations could be fulfilled if the situation stabilizes.* [1]

PepsiCo's shares performance over the past five years (Source: Google) *

McDonald's is holding above expectations

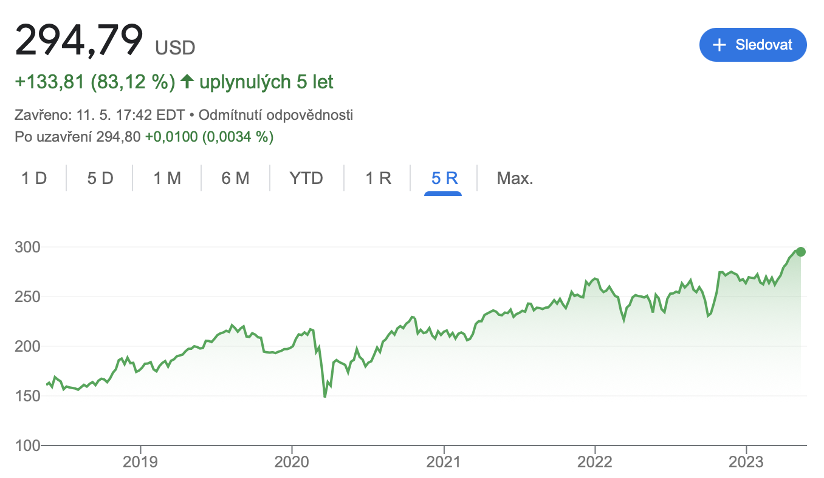

McDonald's Corp's quarterly sales rose 12.6 percent, beating expectations along with other food giants. Refinitiv says this is due to increases in the prices of hamburgers and fries. However, according to McDonald's chief financial officer, Ian Borden, inflation is still putting pressures on cash flow, particularly in restaurants on the old continent. CEO Chris Kempczinski says that despite fewer items per order, McDonald's has fared well in good times and bad, which is supported by the shares' performance, which is in the green when looking at the five-year chart.* He is filled with optimism for the rest of this year in terms of financial results, as McDonald's has a strong name and a broad base of loyal customers around the world.

McDonald's shares performance over the past five years (Source: Google) *

Companies from the consumer goods industry would like to focus on the Chinese market, as they are characterized by a high sales potential after the easing of measures and would like to secure more stable incomes in the still uncertain times. In contrast to European customers, who are more affected by inflation, there is a markedly higher level of consumer optimism among Chinese customers. This year is defined in many analyses as an effort to maintain stability, but if consumers remain relatively immune to the effects of inflation, the results in this sector could be much more positive. [2]

Olivia Lacenova, chief analyst at Wonderinterest Trading Ltd.

* Past performance is no guarantee of future results.

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.