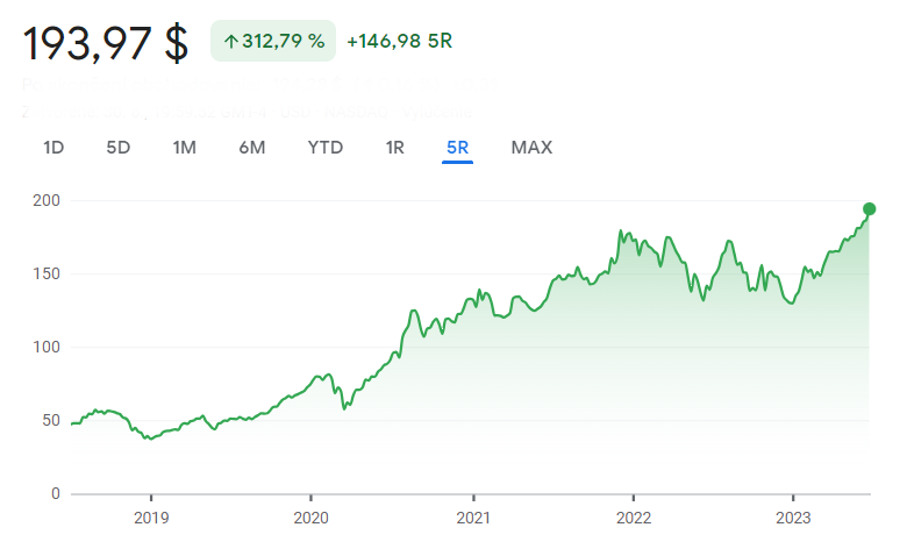

Este año, Apple ha aumentado el valor de sus acciones en más de un 55%, lo que supone una gran noticia para los inversores tras las ligeras fluctuaciones del año anterior.* El aumento de las acciones se debe principalmente al desarrollo de la inteligencia artificial, los nuevos modelos de Mac, el HomePod y las innovaciones en chips. Sin duda, el producto más destacado de Apple este año son unos auriculares de realidad mixta llamados Vision Pro, que han revolucionado el sector. Los accionistas están encantados con el éxito de la compañía, lo que provocaun aumento del sentimiento positivo.

La evolución de las acciones de Apple en los últimos cinco años. (Fuente: Google) *

¿El fin de la colaboración entre Goldman Sachs y Apple?

Por otro lado, la noticia no tan buena es que el segundo mayor banco de inversión del mundo, Goldman Sachs, está considerando interrumpir su colaboración con Apple, que comenzó en 2019 y que consistía en una tarjeta de crédito virtual. Las nuevas conversaciones entre Goldman Sachs y American Express se centran en el traspaso de la tarjeta de crédito junto con otras iniciativas en el marco de la citada colaboración. La tarjeta de crédito de Apple hecha de titanio no tiene un número visible y ofrece a los clientes una recompensa diaria de devolución del 3%. Además, permite realizar pagos mensuales sin intereses en productos Apple. La noticia del cese aún no es oficial y las empresas han declinado hacer comentarios sobre la colaboración.

Prometedora colaboración entre Nokia y Apple

Donde algo viejo acaba, algo nuevo empieza. La empresa finlandesa Nokia ha firmado un acuerdo de licencia a largo plazo con Apple para sus patentes. Nokia fue en su día líder mundial en el campo de los teléfonos móviles y hasta ahora cuenta con una amplia cartera de más de 20.000 patentes, creada tras una inversión de 140.000 millones de euros (152.700 millones de dólares). Este acuerdo sobre la propiedad intelectual de Nokia relacionada con las redes 5G y otras tecnologías se produce cuando la licencia actual entre ambas empresas expira a finales de 2023. El acuerdo proporcionará ingresos a Nokia a partir de enero de 2024[1].

Olivia Lacenova, analista principal de Wonderinterest Trading Ltd.

* Los resultados pasados no garantizan los resultados futuros

[1] Las declaraciones prospectivas se basan en suposiciones y expectativas actuales, que pueden ser inexactas, o en el entorno económico actual, que puede cambiar. Estas afirmaciones no garantizan resultados futuros. Implican riesgos y otras incertidumbres difíciles de predecir. Los resultados pueden diferir materialmente de los expresados o implícitos en las afirmaciones de carácter prospectivo.