The threat of an AI bubble?

In many prestigious stock indices, when a company performs well and financially prospers at a stable pace, its stock price typically rises proportionally, and its weight in the given index also increases. In the case of the S&P 500, Nvidia currently accounts for 7.5 percent, while it’s also important to note that the broader tech sector controls one-third overall, similarly to the peak of the dot-com bubble in 2000. This begins to worry many investors, but objectively it is crucial to point out that from a fundamental point of view, companies are in a much better position. Cash reserves are more than twice as high, expected stock prices relative to revenue over a two-year horizon are half as low, and the margins of the Magnificent Seven, the 7 largest U.S. companies, stand at 28 percent, compared to 16 percent in the year 2000.[1]

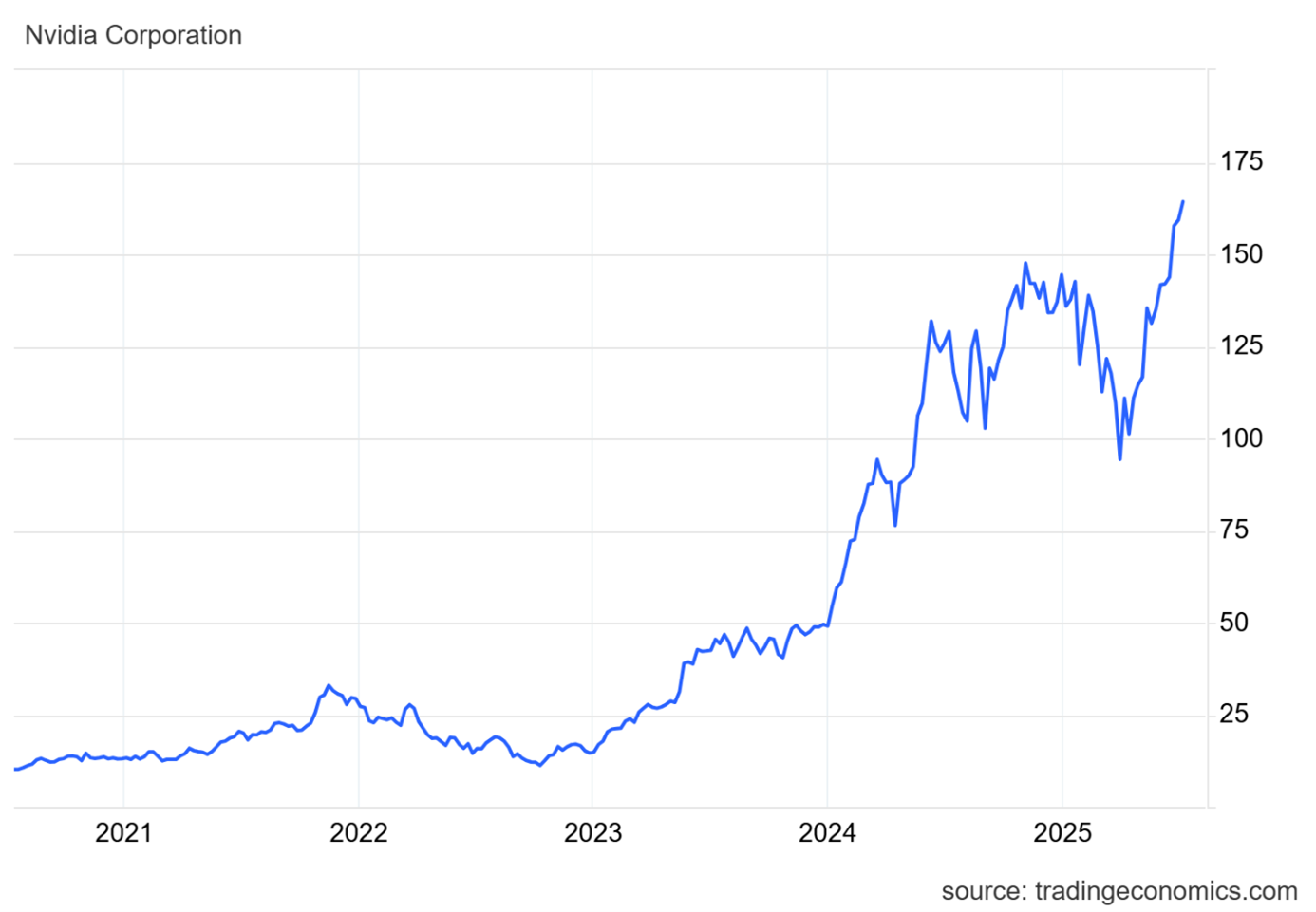

Performance of Nvidia stock over the past five years*

State of the competition

Adding the 4th trillion in market capitalization to Nvidia’s balance is even more attractive given that it comes after a deeper stock market correction that lasted from the beginning of this year until the beginning of April. Some of the mentioned competitors, specifically Apple and Amazon, have still not recovered from this correction and remain below their all-time highs. On the other hand, investors have observed other players whose stock prices have reached relatively distant levels since January, but Nvidia, considering the importance of its product portfolio in the age of AI and cloud, represents one of the most promising candidates for long-term portfolio strengthening.

Buy now or wait?

For investors aiming for consistent success, it is of course essential to assess the stock price beyond just the dry figure of record-breaking. Whether you already own Nvidia shares or are still waiting to enter, allocating the full investment amount at the absolute peak of price performance is generally considered much riskier than waiting to buy during a potential correction. However, for those who still wish to enter the market at the current valuation and are determined to hold the investment long-term, the amount can be split into two halves: the first to be invested at the current market price, and the second reserved for the aforementioned potential future correction.

Conclusion

Nvidia, a company regarded as a technological leader not only in the field of graphics cards but currently especially in the development and deployment of the most advanced artificial intelligence technologies, has reached a new record – 4 trillion in market capitalization. This reflects the ongoing growth of the company’s fundamental value, with strong demand for its products and services even beyond the technology sector, presenting an opportunity for investors seeking to have a stable and diversified company with long-term potential in their portfolios, one that can continue to sustain such a strong trend.

* Past performance is not a guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate or based on the current economic environment, which may change. These statements do not guarantee future performance. They include risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied in any forward-looking statements.