Sugar Crisis

According to Reuters, Cuba is experiencing a significant drop in sugar production, with this year’s harvest expected to reach only about 165,000 metric tons of raw sugar. That is far below the estimate from the state-owned company AzCuba, which oversees cane cultivation and harvesting and had projected 265,000 tons for this year. Sugar production has been declining for several years now. For comparison – between 2022 and 2023, when the harvest was higher than current levels (350,000 tons), it was still at its lowest in over 120 years. An even starker contrast can be seen when compared to 2019, when farmers grew and processed 1.3 million tons of sugar. As the website CiberCuba reports, the dire situation was even acknowledged by Osbel Lorenzo Rodríguez, Secretary of Cuba’s Communist Party.

Unmet Targets

Among the various regions, farmers in Sancti Spíritus performed the “best,” reaching a quota of 19,000 tons. However, according to CiberCuba, the situation is not as rosy as it may seem. Local media did not publish the real figures and also failed to mention that part of their sugar came from another region of Cuba and from Uruguay. Meanwhile, production in the remaining provinces reached only a fraction of their assigned targets. In Villa Clara, for example, it was less than 40 percent. Cienfuegos managed two-thirds of its quota, the region near Santiago de Cuba – the country’s second-largest city – produced just 13 percent, and the eastern region of Las Tunas achieved only 11 percent of its goal.

Consequences of Systemic Failure

The Caribbean sugar industry, once a global powerhouse, has fallen into this state due to the country's overall poor condition, closely tied to a lack of investment, resources, and fuel. This has resulted in an inability to repair outdated machinery, compounded by issues with the electrical infrastructure and frequent power outages. The COVID-19 pandemic and recent U.S. sanctions must also be mentioned as contributing factors. Due to these challenges, fewer than half of the country's 14 mills were operational at the beginning of this year. Mismanagement and the declining state of the agricultural sector have deeply affected ordinary Cubans for several years now. People are not receiving the amount of food they need. Two years ago, the Cuban government admitted it had failed to meet its 2019 promise of providing five kilograms of protein per person per month, and the situation has since worsened. According to CiberCuba, the fishing industry currently covers only about half of the demand, and bread rations have dropped to just 60 grams.

Rum is also at risk

Sugar is an important component of Cuba's functioning economy due to the country’s status, which is why Cuba is trying to mitigate the impacts at least by importing it from other countries. While imports may cover household consumption and other areas of production, it’s not very positive for the distilling industry—especially when it comes to Cuban rum, which, according to tradition, must include only local ingredients. Since sugar and rum go hand in hand, the challenges are affecting this brown spirit as well. According to the National Office of Statistics and Information, the production of 96-percent sugar-based ethanol dropped by as much as 70 percent in 2024, falling to 174 thousand hectolitres. For comparison, in 2019, it was as high as 573 thousand hectolitres. It looks like tough times are still ahead for quality rum producers. Sugar supplies are planned for long periods in advance during rum production, since the alcohol must age for a certain time, meaning today’s historic lows will affect the amount of rum on store shelves only later on.

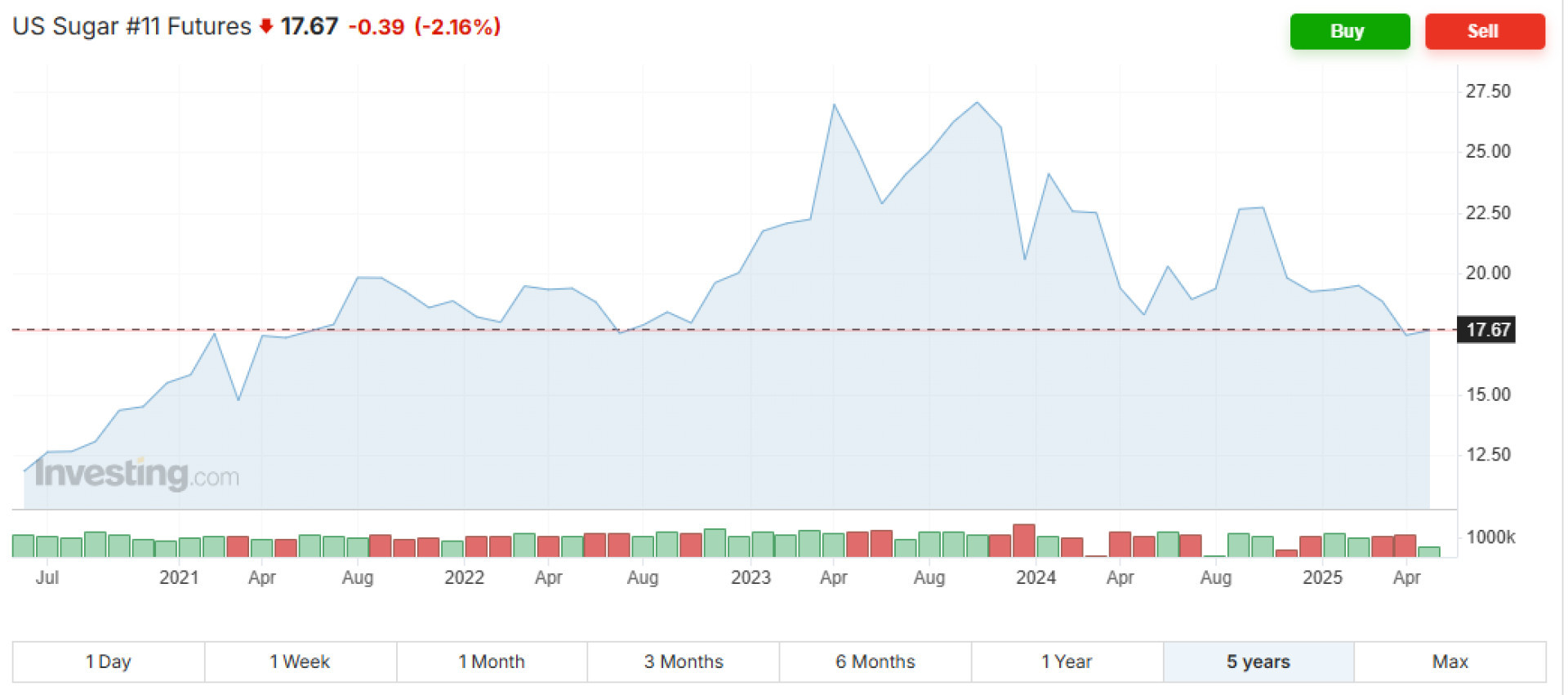

Prices on the exchange are falling

Looking at the development of sugar prices on the exchange, on May 16, 2025, it stood at $17.67. The commodity had been steadily rising since 2020—with a few corrections—reaching a five-year high of about $27 in October 2023. Since then, however, it has started to decline to current levels, with a flash of recovery in the fall of last year when it briefly reached $22. Compared to the same period last year, this marks a 2.5 percent drop, while from a five-year perspective, sugar prices are up 49 percent.*

Sugar price development over the past 5 years. (Source: Investing.com)*

* Past performance is not indicative of future results.