Inflation started rising about 3 years ago and has reached really high levels in the last year. That is why it has been one of the most discussed topics recently. Everyone is currently waiting for the time to come when interest rates will be cut. Inflation is in the focus of the markets, which are already guessing when the central banks will start to cut interest rates. This topic is attracting increased attention all over the world, from the US, through the EU, to Australia and Japan.

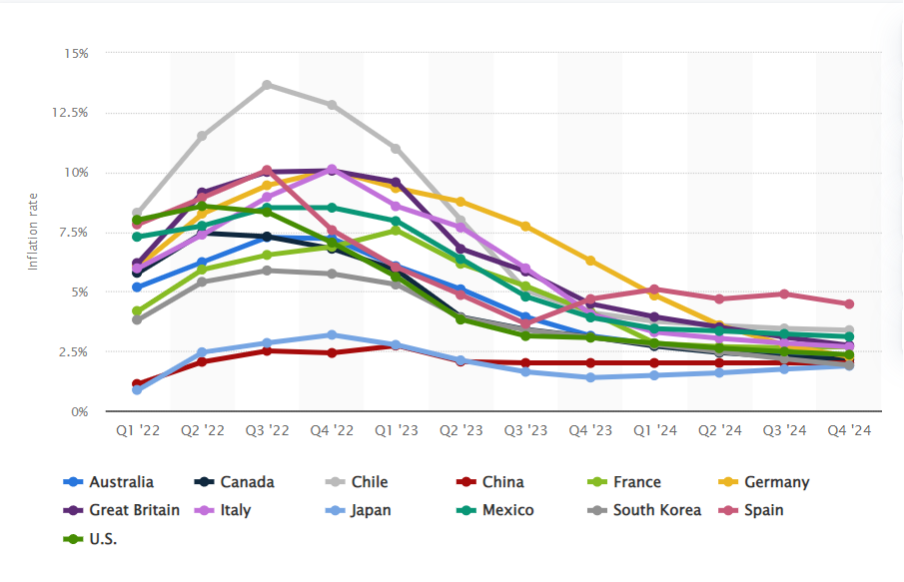

Forecast of the rate of inflation in selected countries of the world from Q1 2022 to Q4 2024 (Source: Statista)

At the start of 2023, inflation is rising fastest in Chile and the UK. Consumer prices in Chile rose well above forecast at the start of the year, due to higher food and beverage costs. Prices in Chile rose 0.8% from December, higher than all expected estimates.

In the UK, we could see that inflation rose to an annual level of 10.5% at the end of 2022, which represents a decrease for the second month in a row. The situation in the country is by no means good, the high cost of living in the country has caused widespread protests by public sector workers, whose average wage growth has lagged far behind that of the private sector. The central bank raised interest rates by 50 basis points last week, bringing the bank's main interest rate to 4%.

USA

The situation in the USA is closely monitored not only by investors, and data on inflation is on the list of mandatory monitored data in the USA. In the West we see a downward trend, meaning that the inflation rate has been below expectations for three months in a row after rising to ten-year highs. The decline can be attributed mainly to the Fed's aggressive policy aimed at the most significant increase in rates since the 1980s. Investors expect and believe that the Fed will be able to reduce inflation without triggering a sharp slowdown in growth. The American central bank may raise rates again before the end of the year, which would hit the rally that supported stocks and bonds after last year's slump.

Japan

In Japan, inflation climbed to a new 41-year high. For January, Japan saw core consumer price levels rise as much as 4%, which did not please the Bank of Japan. It is becoming increasingly difficult for people in the country to face rising inflation as businesses pass on higher costs to their customers. Attention has also been focused on the choice of the next head of the Bank of Japan (BOJ), as it will soon be time for a change in that post. However, investors are surprised for now as the BOJ has announced it will keep rates close to zero despite rapidly rising costs.

Olivia Lacenova, analyst at Wonderinterest Trading Ltd.