The strength of DJSI World is highlighted primarily by its historical performance. From the beginning of the year until the last day of October, the index gained 22.96 percent, and similarly attractive values can be seen in a longer-term timeframe. The average return over the past three years stands at 21.29 percent. Looking at a 5-year horizon, this value represents 15.19 percent, and lastly, the average performance over a 10-year horizon settled at a solid 12.18 percent. It is also crucial to mention how the index manages downturns. During 2022, when the entire capital market experienced a correction, DJSI World handled the pressure relatively well – it declined by 15.6 percent, which is much less than the rest of the market. The question for investors remains: which companies contributed most to the overall performance of the index? Considering the index’s ESG focus, one might logically assume that it concentrates exclusively on renewable energy or electromobility, but the opposite is true. The primary drivers of the index are companies operating in the technology, pharmaceutical, and industrial sectors.*

Microsoft

The first company on the list is the technology giant Microsoft, which has long held a leading position in sustainability. According to official data, the company has committed to achieving carbon neutrality by 2030, partly through investments in renewable energy sources and innovations in cloud services. In addition, Microsoft actively supports the circular economy, implements efficient recycling programs, and focuses on reducing the environmental impact of its operations. The company also recognizes that many other companies have similar goals, and therefore invests significant financial resources in technologies that help reduce environmental footprints across sectors. Microsoft’s efforts have also long rewarded investors through stock price growth – over a five-year horizon, the company’s value on the stock market rose to an all-time high reached in July 2025, by 160 percent*. For investors interested in this company, it is important to note that since that peak, the price has corrected downward by approximately 15 percent*, which now represents a generally much more favorable entry position than buying at the performance peak.

Five-year stock price performance of Microsoft*

Taiwan Semiconductor Manufacturing

Another company at the top of the list is the global leader in semiconductor manufacturing. TSMC is one of the world’s largest technology companies and a firm with extraordinary emphasis on sustainable manufacturing processes, particularly optimizing electricity consumption. The company also contributes to its overall ESG profile through its engagement in the use of predominantly natural resources. Following the positive stock price development of Microsoft, TSMC certainly does not lag behind. The Taiwanese giant, whose shares are primarily listed on the domestic TWSE exchange, has grown by more than 200 percent over the past five years.*

Five-year stock price performance of Taiwan Semiconductor Manufacturing*

Tencent

The third strongest player in the index is the Chinese technology company Tencent, which has established itself as a leader in communication services and digital entertainment. In addition to its dominant positions in gaming and social networks, Tencent is increasingly focusing on corporate responsibility and its environmental consequences. The company strives to minimize its environmental impact by investing in renewable energy sources and necessary innovations aimed at reducing carbon emissions. Tencent also focuses on improving living conditions through various social programs, such as supporting education in China. The trajectory of Tencent’s stock price on the Hong Kong Stock Exchange over the past five years reflects somewhat milder growth – currently, the price is up by approximately 20 percent. At the same time, it is necessary to add that from the 2022 low, the stock has grown by more than 250 percent to the current levels.*

Five-year stock price performance of Tencent*

AbbVie

A pharmaceutical representative in an investor’s portfolio may be AbbVie. This stock focuses on innovations in medicine and healthcare that not only improve quality of life but are also environmentally friendly. In connection with this, the company is also involved in supporting healthcare for disadvantaged communities and projects aimed at prevention and treatment of chronic diseases. Investments in renewable energy sources are also a standard part of its approach. Regarding its performance on the New York Stock Exchange, AbbVie has grown by 125 percent over five years.*

Five-year stock price performance of AbbVie*

Cisco

One of the world’s leading information technology companies actively participating in sustainable solutions is Cisco. This long-standing giant, like the previously mentioned companies, invests in technologies that support energy efficiency and CO₂ reduction, especially in services related to computing power. In this case, Cisco’s shares are listed on the Nasdaq, where from the 2020 low, they have risen by 147 percent.*

Five-year stock price performance of Cisco*

SAP

The confirmation that technological advancement and sustainability can go hand in hand is reflected in the remaining top-performing companies of the index – namely SAP, Salesforce, Abbott Laboratories, Siemens, and Linde. SAP, as a global representative in enterprise software solutions, helps companies manage internal processes more efficiently and reduce energy consumption, while applying the same principles in its own operations, with emphasis on renewable energy and emission reduction. In terms of stock performance, SAP is also a strong player – the five-year horizon has provided ample time for its value to rise by more than 100 percent to current levels.*

Five-year stock price performance of SAP*

Salesforce

Salesforce connects top technological solutions with ecological initiatives and social responsibility within its cloud ecosystem – supporting diversity, education, and access to quality care. In this case, the situation is similar to Tencent – the stock price over the same period is down by 12 percent*, which, however, offers potential to acquire a promising company at a more favorable valuation.

Five-year stock price performance of Salesforce*

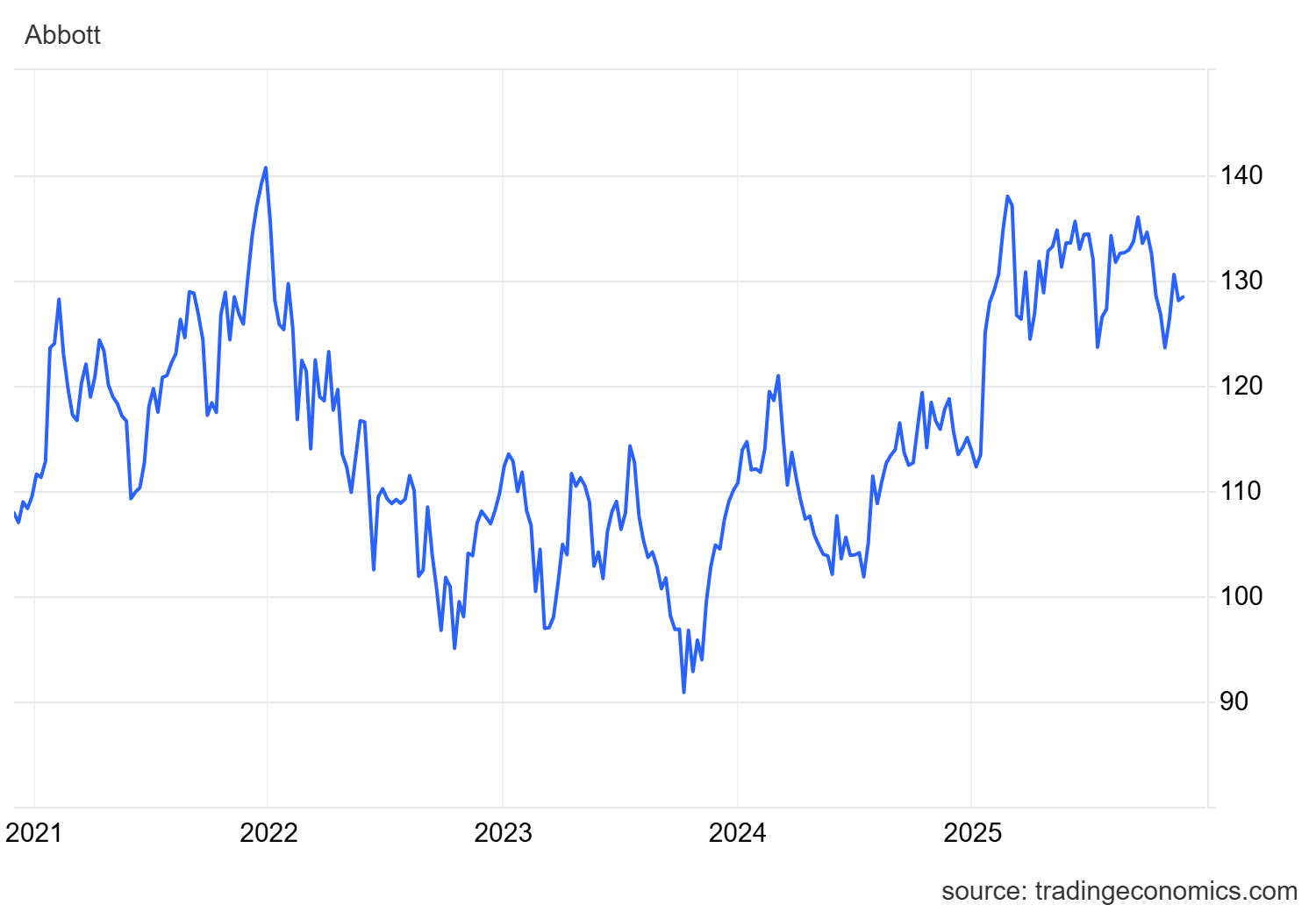

Abbott Laboratories

Abbott Laboratories has long been pushing the boundaries of pharmaceutical innovation, placing significant emphasis on sustainability, whether through the development of environmentally friendly medical products or support for healthcare in less developed regions. This stock has delivered considerable stability over the past five years, with its overall value rising by more than 15 percent.*

Five-year stock price performance of Abbott Laboratories*

Siemens

Siemens has also become a leader in the sustainable transformation of industry – investing in intelligent energy solutions, environmentally friendly transportation, and so-called smart cities, thus contributing to more efficient and cleaner infrastructure worldwide. Siemens has rewarded investors over the past five years with stock appreciation exceeding 100 percent.*

Five-year stock price performance of Siemens*

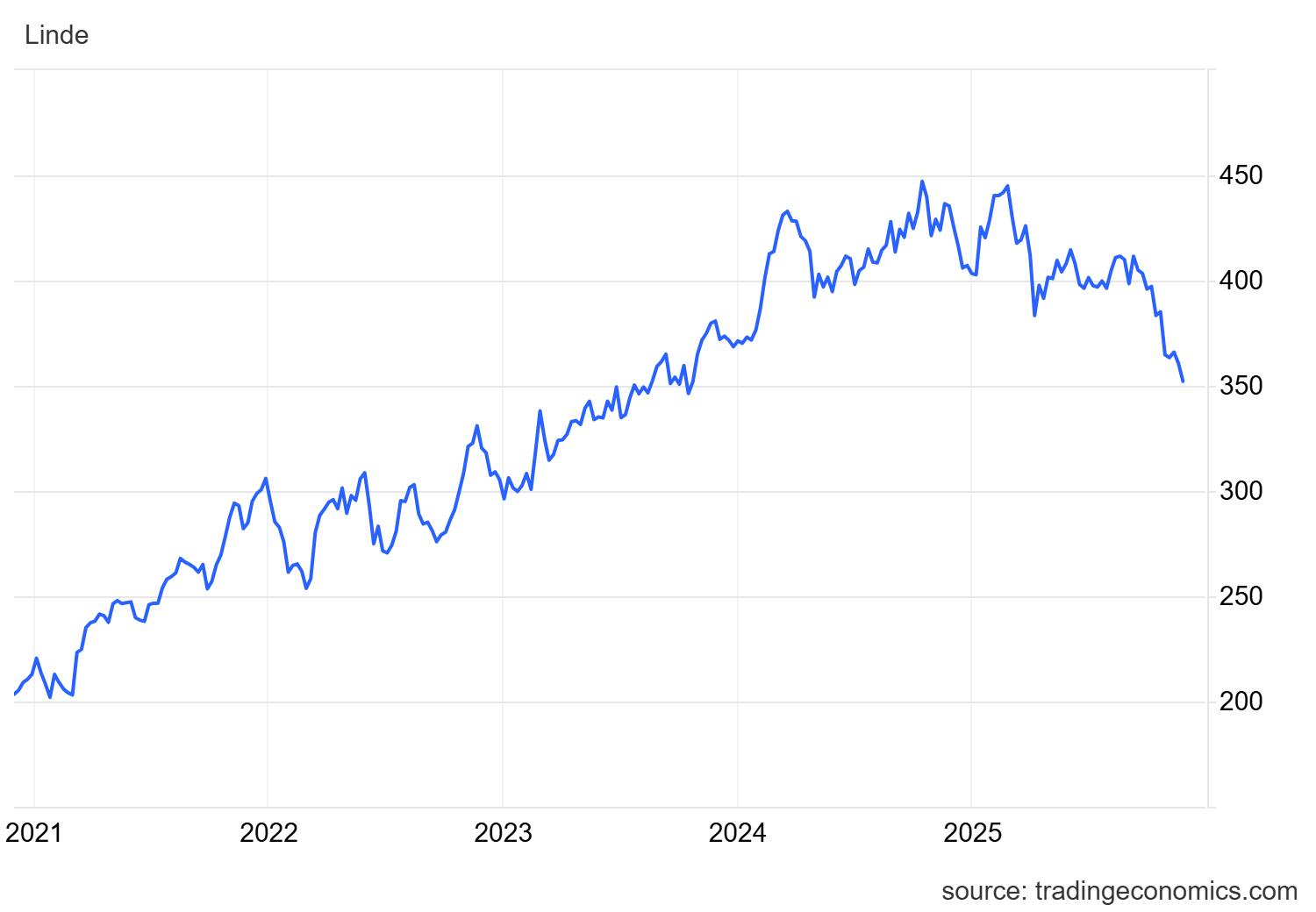

Linde

Finally, Linde plays a key role in the industrial gases sector, focusing on decarbonization and carbon-capture technologies. Shares listed on the Nasdaq have risen by approximately 60 percent over the past five years.* In conclusion, it can be stated that the common denominator of these companies is a clear commitment to innovation, environmental responsibility, and long-term sustainability, supported by the technological and economic achievements of each of them.

Five-year stock price performance of Linde*

* Past performance is not garantee of future results.